Taxes might be an inevitable certainty for most of us, but for the ultra-wealthy, hefty tax bills are anything but. There are some truly ingenious and often controversial methods billionaires employ to minimize their tax obligations, from clever stock strategies to exploiting legal loopholes. Each of these revelations not only showcases their financial acumen but also sparks debates about the tax system's fairness.

The Ultra Wealth Effect

Credit: Instagram

Elon Musk, Warren Buffett, and Jeff Bezos have famously minimized their tax liabilities through a strategic non-sale of their stock holdings. The key is the U.S. tax system's focus on taxing income, not wealth. By not selling their stocks, these billionaires avoid creating taxable income, meanwhile accessing their fortunes through loans, which are not taxed. Buffett advocates for his wealth to benefit charity, emphasizing his adherence to the law, while Musk's response is cryptically minimal.

The $5 Billion IRA

Credit: Wikimedia Commons

Peter Thiel's approach involves a Roth IRA—initially designed to aid average Americans in saving for retirement—where he parked undervalued PayPal shares in 1999. This account has since ballooned to $5 billion, shielded from taxes. The maneuver, skirting the edges of IRS regulations, highlights the potential for immense tax-free gains, raising questions about the intended use of such retirement accounts.

The $1 Billion Parlor Trick

Credit: Youtube

Jeff Yass of Susquehanna International Group maneuvers to convert short-term trading gains, which are taxed higher, into more favorable long-term investment returns. This strategy has reportedly saved his firm over $1 billion in taxes over six years, underscoring the lengths to which some will go to reduce their tax rates, all within the bounds of the law.

The Magic of Sports Ownership

Credit: flickr

Former Microsoft CEO Steve Ballmer leverages the ownership of the Los Angeles Clippers to his tax advantage. Despite the team's profitability, tax rules allow for deductions akin to depreciating equipment, thereby diminishing reported income. Interestingly, such strategies result in much lower tax rates for owners compared to their players or even stadium staff, highlighting a stark contrast in tax burden distribution.

The Real Estate and Oil Businesses Can Both Be Tax Havens

Credit: flickr

Stephen Ross, a real estate mogul and owner of the Miami Dolphins, and an unnamed oil tycoon utilize industry-specific tax breaks to nearly erase their taxable income while continuing to enrich their portfolios. These sectors offer vast opportunities for legally avoiding taxes, from depreciation to specific write-offs related to operational losses.

Even a Billionaire's Hobbies Can Pay Off at Tax Time

Credit: Youtube

From thoroughbred racehorses to luxury hotels, the ultrawealthy turn their leisure pursuits into tax-saving ventures. Owners of top racehorses and billionaires like Ty Warner, who invested in iconic hotels, benefit from massive tax deductions that often lead to years without paying federal income taxes.

Taxes Too High? Change the Tax Laws

Credit: freepik

Some billionaires go a step further by influencing tax legislation. Major contributions to political campaigns have led to substantial tax cuts, notably the "big, beautiful tax cut" for passthrough businesses, significantly reducing the tax liabilities for the ultrawealthy, proving that policy changes can be a powerful tool in wealth preservation.

Why Tech Billionaires Pay Less Than Hedge-Fund Managers

Credit: freepik

The disparity in tax rates among the rich is also influenced by the nature of their income. Tech billionaires, benefiting from long-term capital gains tax rates, tend to pay less compared to other high earners like hedge fund managers, who often receive income taxed at higher rates. This differentiation in tax treatment underscores the complexities and inequities of the system.

Brother, Can You Spare a Stimulus Check?

Credit: istockphoto

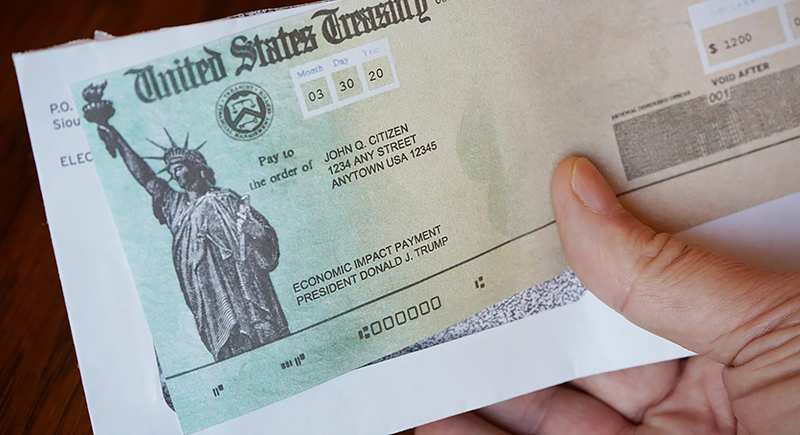

Ironically, some billionaires reported incomes low enough to qualify them for government stimulus checks during the 2020 pandemic relief efforts. This paradox highlights the extreme measures some take to reduce their taxable income, at times positioning them among the economically needy on paper.

How Wealthy Families Pass Billions to Heirs While Avoiding Taxes

Credit: istockphoto

The estate tax, intended to affect only the wealthiest, often misses its mark due to trusts and other estate-planning tools that shield vast fortunes from taxation. This practice allows wealth to be transferred across generations without significant tax penalties, perpetuating wealth disparities and raising questions about the effectiveness of current tax policies in addressing inequality.